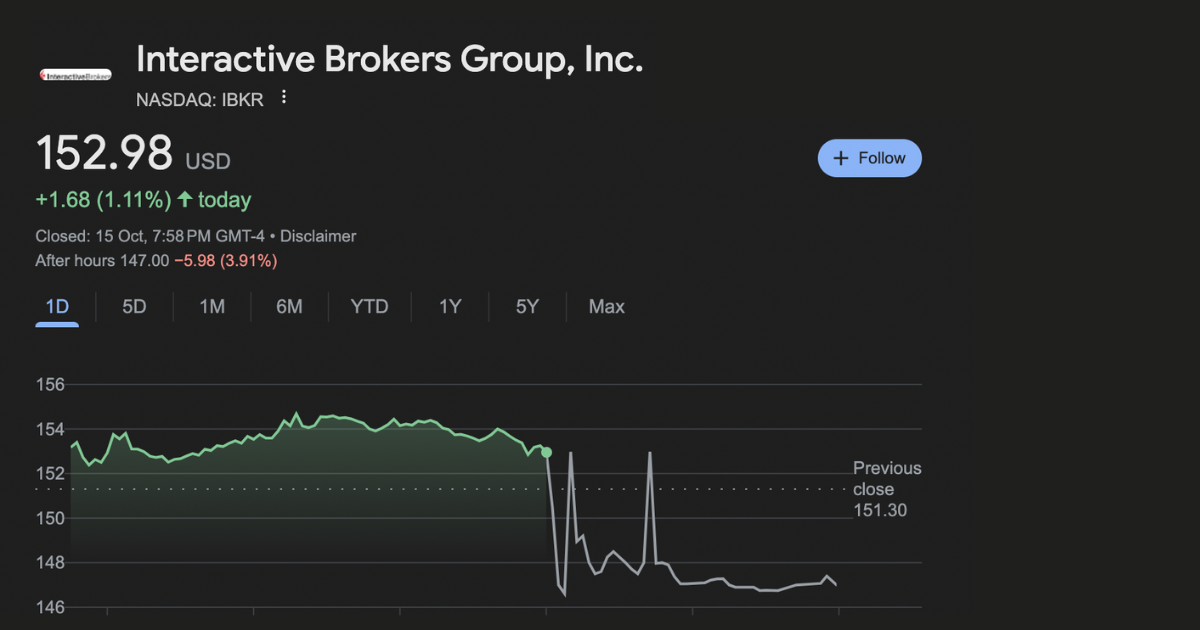

Interactive Brokers Group, Inc announced its third-quarter earnings, falling short of analyst expectations and causing its shares to drop nearly 4% in after-hours trading on Tuesday.

The global automated electronic broker reported adjusted earnings per share of $1.75 for the quarter ending September 30, below the consensus estimate of $1.81. However, the company outperformed on revenue, posting $1.365 billion compared to the expected $1.34 billion.

Commission revenue surged by 31% year-over-year to $435 million, driven by increased customer trading activity. Trading volumes for options, stocks, and futures grew by 35%, 22%, and 13% respectively, compared to the same period last year.

Net interest income saw a 9% rise to $802 million, fueled by higher customer margin loans and credit balances.

"We experienced strong growth in our core metrics this quarter, with total customer accounts up 28% year-over-year to 3.12 million and customer equity jumping 46% to $541.5 billion," said Milan Galik, CEO of Interactive Brokers.

Despite exceeding revenue expectations, the earnings miss seemed to dampen investor sentiment, leading to a 3.99% drop in Interactive Brokers’ stock price after the earnings report.

The company also declared a quarterly cash dividend of $0.25 per share, payable on December 13 to shareholders of record as of November 29.

Recently, FX Newsroom also reported that Interactive Brokers has partnered with Saudi investment bank SNB Capital to give eligible international investors access to the Saudi Exchange, marking the first time a global broker has offered direct trading in Saudi equities through its platform.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply