If you're a trader, you've likely come across the term ‘trading spreads.’ But what exactly is a trading spread, and why does it matter so much to traders of all levels?

Whether you're new to the markets or a seasoned investor, understanding trading spreads is crucial for making better-informed decisions and maximizing your profits as a trader.

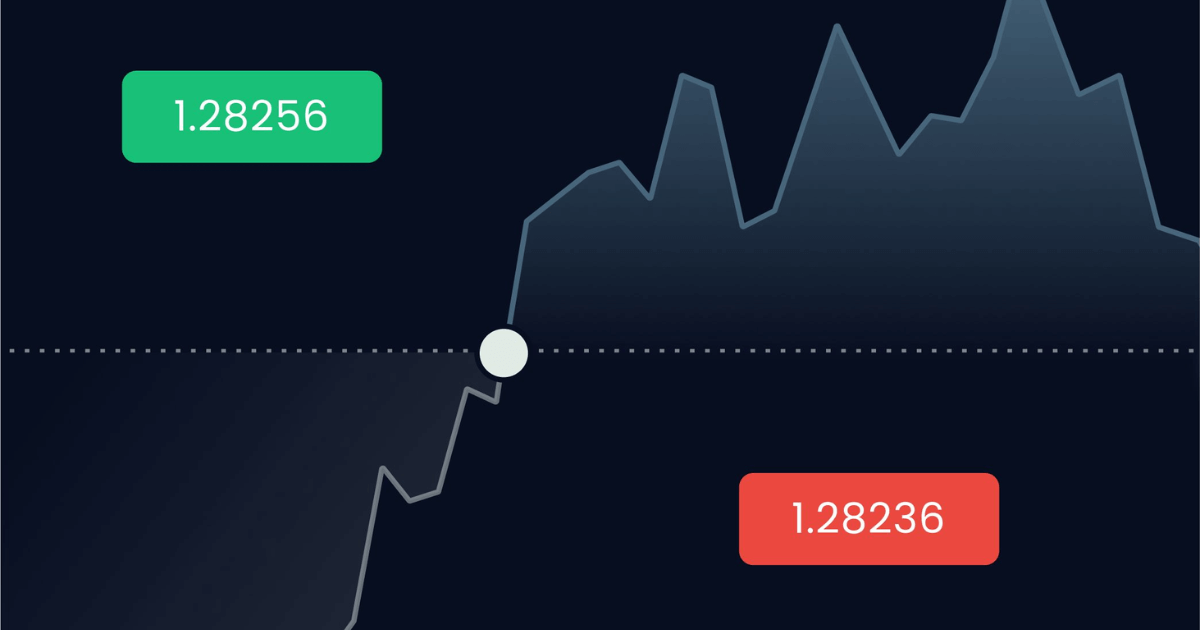

At its core, the spread in trading is the difference between the buying price (ask) and the selling price (bid) of a financial instrument. It’s how brokers make money, especially in markets like forex and CFDs.

Think of it as the cost of entry—every time you place a trade, you’re effectively paying the spread to gain access to the market. Understanding this cost can help you strategize better, reduce expenses, and ultimately boost your returns.

Imagine it this way. If you're trading EUR/USD and the price to buy (ask) is 1.1050 while the price to sell (bid) is 1.1048, the spread would be 2 pips. It may not seem like much, but those tiny margins can add up quickly, especially when trading at a high frequency.

The tighter the spread, the less you pay upfront, which is why low spreads are such a big deal for traders.

Spreads are probably your biggest trading cost—they influence everything from the types of strategies you can employ to the market conditions that are most favorable. For instance, during times of high market volatility or lower liquidity, spreads often widen.

This means you’re paying more for each trade, which can eat into your profits or even turn winning trades into losses. On the other hand, during periods of calm and steady market activity, spreads tend to narrow, making it more cost-effective to trade.

🔺 Wider spreads mean: Higher trading costs, more risk in volatile times.

🔺 Narrower spreads mean: Lower costs, more opportunities during stable periods.

For traders using strategies that involve frequent buying and selling—like scalping—low spreads are absolutely essential. Paying high spreads on every single trade would quickly make such strategies unprofitable.

That’s why traders always prefer brokers that offer tighter spreads, especially for highly traded currency pairs like EUR/USD or GBP/USD.

Spreads aren’t static, and can change based on a number of factors.

Market conditions play a significant role in determining the spreads—they tend to widen during periods of significant news events or economic releases, when markets are more unpredictable and volatile.

Liquidity is another big factor: more liquid assets, like major currency pairs, generally have narrower spreads because there’s more market activity.

You also need to consider your choice of broker. Some brokers use fixed spreads, which means the cost stays the same regardless of market conditions.

However the majority offer variable spreads, which change based on liquidity and volatility. Variable spreads can save you money during calm market periods, but they might widen considerably during higher volatility.

Try to choose a broker that offers low and stable spreads, as this will lower your trading costs in the long-run.

Understanding how to manage spreads can make a noticeable difference in your trading. One of the most effective ways to minimize the impact of spreads is to trade during peak market hours.

For example, the forex market is most active when the London and New York sessions overlap, typically resulting in narrower spreads due to increased liquidity.

If you’re trading during off-hours, be prepared for spreads to widen, especially for less popular pairs or exotic currencies.

🔺 Trade during peak hours: Overlaps like London and New York sessions.

🔺 Choose assets with high liquidity: Major currency pairs often have tighter spreads.

🔺 Stay away from news trading: Spreads widen during major news releases like CPI.

Another approach is to align your trading style with the spreads you’re dealing with.

If you’re a long-term trader, a slightly wider spread might not matter as much because you're targeting larger price movements that dwarf the initial spread cost.

But if you're a day trader or scalper, spread size can significantly impact profitability.

It’s also important to distinguish between spreads and commissions.

Some brokers make their money purely off the spread, while others charge a small commission per trade in addition to offering tighter spreads.

Which one’s better? It depends on your trading volume and style. High-volume traders often prefer commission-based accounts with lower spreads, while beginners may stick to all-in-one spread pricing for simplicity.

Trading spreads might seem like a small detail, but they have a big impact on your trading costs and profitability.

With the right broker and understanding how different market conditions affect spreads, you can lower your costs and become a smarter & more aware trader.

Spreads are, in essence, the price you pay to participate in the market. Mastering how they work is one of the keys to becoming a more successful trader.

After all, every pip counts—and understanding spreads can help you keep more of those pips where they belong—in your account.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply