Retail trading is tough. If you’ve ever tried to turn a few hundred dollars into a meaningful trading account, you know the struggle.

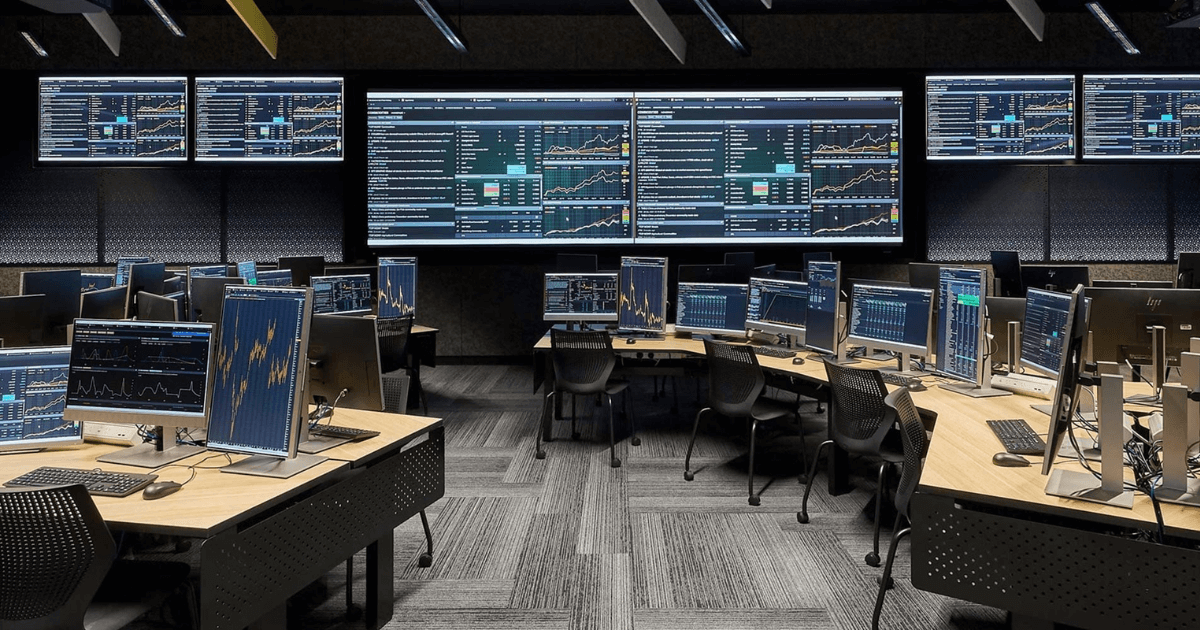

One development which aims to combat this stuggle is proprietary trading, or prop trading for short.

In recent years, the retail FX and CFD trading landscape has undergone significant changes, and one of the most notable developments is the growing interest in prop trading.

With traditional retail traders struggling to compete against the immense capital resources of major banks and hedge funds, prop trading is emerging as a potential solution, offering traders access to substantial account sizes—sometimes upwards of $200,000—without risking their own funds.

But what exactly is driving this trend, and how is the industry responding to the challenges and opportunities it presents?

For many retail traders, the core issue is this: starting with a small account—often as little as $200—limits the potential for meaningful returns.

In a market where institutional players control billions in capital, retail traders are at a distinct disadvantage. As a result, many quickly exhaust their accounts, with around 90% of retail traders losing money.

Prop trading seeks to address this imbalance by providing traders with the capital they need to make larger, more impactful trades. Rather than risking their own funds, traders can access significant amounts of capital from a prop trading firm, giving them a fighting chance in a highly competitive market.

However, these opportunities come with strict conditions. Most prop firms impose tight drawdown limits—typically between 5-10%—meaning traders risk losing access to their accounts if they exceed these limits. While this may seem restrictive, it is designed to protect the firm’s capital while also encouraging traders to adopt disciplined risk management strategies.

Despite the growing appeal of prop trading, the model hasn't been without controversy. A significant issue facing the industry is the lack of regulation around prop firms, which has led to skepticism among lots of brokers and traders.

The unregulated nature of the sector has raised concerns about the legitimacy of some firms, with critics pointing out the risks involved in entering an industry that lacks clear oversight.

However, the situation is slowly evolving. Recent partnerships, such as the collaboration between RegTech firm Muinmos and technology provider Brokeree Solutions, are paving the way for greater transparency and accountability in the prop trading space.

Their joint efforts aim to help brokers offer compliant, legitimate prop trading services by integrating Brokeree’s Prop Pulse technology—a risk management and account management solution—with Muinmos’ regulatory compliance platform.

According to Remonda Kirketerp-Møller, Founder and CEO of Muinmos, “For regulated brokers who have the right controls and risk management in place, prop trading presents an excellent opportunity for an additional revenue stream.”

While prop trading still faces hurdles, including ongoing regulatory concerns, the model has the potential to become a major fixture in the retail FX industry. As more firms integrate compliance and risk management technologies into their prop trading offerings, and as regulators catch up with the model’s growing popularity, the space may see widespread adoption.

The benefits of prop trading are clear. It levels the playing field by providing retail traders with the capital they need to compete in a market dominated by institutions. The stricter rules around drawdowns that come with it can also serve as valuable discipline for traders, helping them to adopt a more measured trading approach.

The industry has already seen some big players enter the prop trading space. Several firms from the traditional CFD sector, including well-known names like OANDA, Hantec Markets, and IC Markets, have introduced prop trading options, signaling a broader shift toward this model.

These firms are offering traders access to larger accounts, complete with the regulatory compliance and fund withdrawal guarantees that retail traders expect.

As regulatory frameworks evolve and more firms enter the market, prop trading could soon become a mainstream offering within the retail trading space. While it currently sits in a somewhat gray area, the potential for growth is significant, especially as firms like Muinmos and Brokeree take steps to address the risks associated with the model.

For brokers, prop trading offers a way to differentiate themselves in a highly competitive market, providing traders with an opportunity to access larger accounts without risking their personal savings. As the industry continues to adapt, it’s likely that we’ll see more firms adopting this model in the coming years, potentially reshaping the future of retail trading.

And with the right safeguards in place, it might just be the solution traders have been waiting for.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply