Founded

1992

Minimum Deposit

$5000

Leverage

1:100

Platforms

SaxoTraderGO, SaxoTraderPro, TradingView

Clients

1.1 million+

Support

24/5

Regulation

FSA, FCA, ACPR, FINMA, MAS, DFSA, FSA, SFC, ASIC

Saxo Bank, established in 1992, is a leading global online broker known for its comprehensive range of trading instruments and advanced trading platforms.

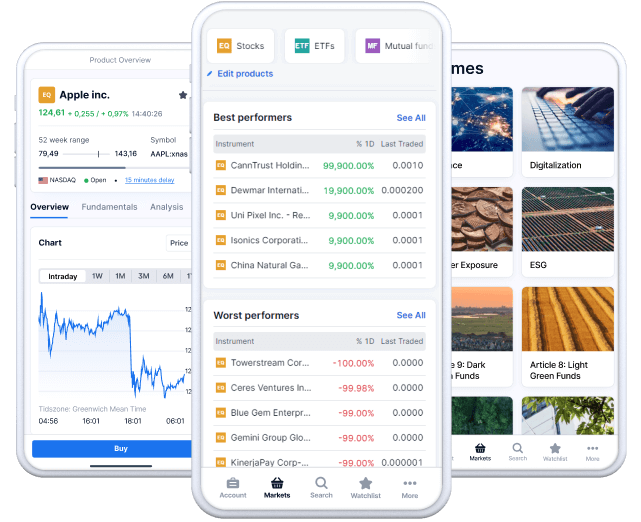

Offering access to stocks, ETFs, mutual funds, bonds, and other sophisticated financial products across 50 global exchanges, Saxo Bank is particularly well-suited for professional and high-volume traders.

With high capital requirements for its Platinum and VIP accounts, the broker provides reduced fees, exclusive events, and advanced trading features, making it ideal for experienced traders seeking a robust and secure trading environment.

Saxo Bank gives traders access to a large set of stocks, ETFs, mutual funds, bonds as well as more sophisticated instruments for traders across 50 global exchanges.

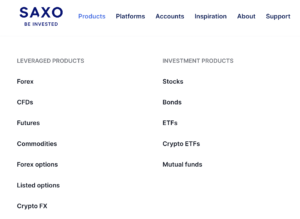

Saxo Bank offers clients access to a comprehensive lineup of instruments, comprising both leveraged and non-leveraged products, that covers a multitude of asset classes. As advertised on its UK and international Websites, the available instruments include, but are not limited to:

🔺 182 forex spot pairs.

🔺 140 forex forwards.

🔺 44 forex vanilla options.

🔺 200+ futures contracts.

🔺 19,000+ stocks

🔺 1,200+ listed options

🔺 9,000+ CFDs.

🔺 19 commodity CFDs.

🔺 5,000+ bonds

🔺 3,000+ Exchange Traded Funds

Saxo Bank offers a mixed fee structure with notable differences across various asset classes. While the trading and non-trading fees are generally average, Saxo Bank does offer interest on uninvested cash, which is a positive feature.

Stock fees

Saxo Bank’s US stock fees are significantly lower than the industry average. The standard fee is 0.08% of the trade value with a $1 minimum. For VIP clients, the commission can drop to as low as 0.03% of the trade value with the same $1 minimum.

FX fees

All FX fees are incorporated into the spread, with no separate commission. For example, the EUR/USD spread is 0.8.

Options fees

Saxo’s fees for US stock index options are higher than the industry average. The standard fee is $2 per contract, but for VIP clients, this can be reduced to $0.75 per contract.

Other fees

US Index Futures: The fee is $3 per contract, which can be reduced to $1 per contract for VIP clients.

Index CFDs: All fees are built into the spread, with the S&P 500 index CFDs having a spread of 0.5.

Stock CFDs: The standard commission is $0.02 per share with a $4 minimum. For VIP clients, the minimum can be as low as $1.

Bond CFDs: The fee is 0.2% of the trade value with a €20 minimum. For VIP clients, this can be reduced to 0.05% of the trade value with the same €20 minimum.

Saxo Bank’s fee structure, while varied, offers competitive rates, particularly for VIP clients who benefit from significantly reduced commissions and spreads.

The minimum deposit for the entry-level Classic account is €5000, while Saxo’s Platinum and VIP accounts require minimums of $200,000 and $1,000,000.

Saxo Bank offers credit and debit card deposits, in addition to wire transfers, but e-wallets are not available.

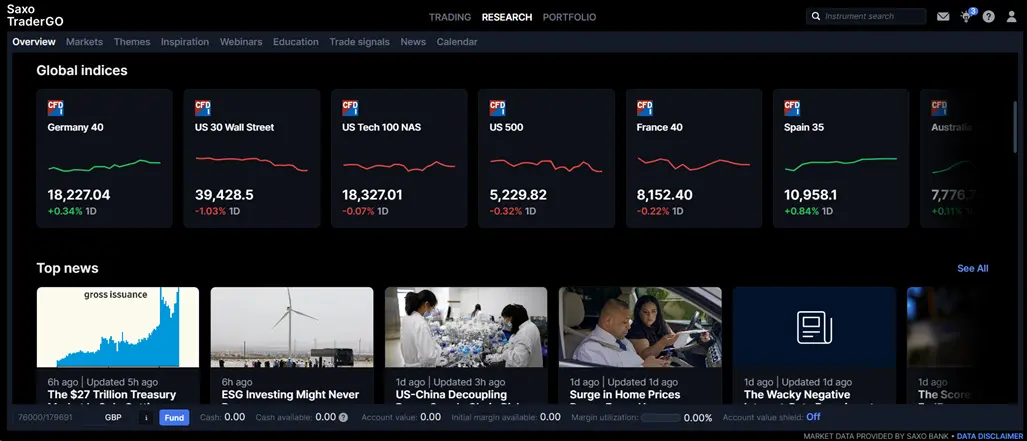

Saxo Bank’s flagship trading suite includes SaxoTraderGO (web) and SaxoTraderPRO (desktop), as well as third-party platforms like TradingView, MultiCharts, and trading connectivity via API.

Saxo’s proprietary platform suite continues to improve with expanded research modules while maintaining its existing look and feel.

SaxoTraderPRO Desktop: Saxo’s award-winning flagship desktop platform, SaxoTraderPRO, mirrors SaxoTraderGO in both appearance and functionality. However, the PRO platform offers a broader range of professional trading features.

For example, PRO supports up to six monitors, streaming Level 2 order books, streaming time and sales, and algorithmic orders. It’s important to note that additional data subscriptions are required to use tools like the streaming Level 2 order book, which is a standard industry practice.

Charting on SaxoTraderPRO is as powerful as on the web version. Subtle touches are seamlessly incorporated, such as countdown timers displaying the time remaining in each candle, enhancing the overall trading experience.

Saxo Bank offers three distinct account tiers tailored to different levels of investment.

🔺 Classic: The Classic account requires no minimum initial funding and provides standard pricing. Platinum: The Platinum account, requiring a minimum initial funding of 250,000 CHF, offers the same features as the Classic account but with reduced prices and priority support.

🔺 VIP: For those who invest at least 1,000,000 CHF, the VIP account provides even lower prices than the Platinum tier, along with access to trading experts and exclusive events.

Saxo Bank is well-established as a safe and reliable broker, backed by over 30 years of industry experience. The broker operates in several countries and is supervised by the following financial authorities:

🔺 EU and some international clients – Danish Financial Services Agency (FSA)

🔺 UK – Financial Conduct Authority (FCA)

🔺 UAE – Dubai Financial Services Authority (DFSA)

🔺 France – French Prudential Supervisory Authority (ACPR)

🔺 Italy – Commissione Nazionale per le Società e la Borsa and Bank of Italy

🔺 Switzerland – Swiss Financial Market Supervisory Authority (FINMA)

🔺 Singapore – Monetary Authority of Singapore (MAS)

🔺 Japan – Japanese Financial Services Authority (FSA)

🔺 Hong Kong – Hong Kong Securities and Futures Commission (SFC)

🔺 Australia – Australian Securities and Investments Commission (ASIC)

Saxo Bank integrates top-notch in-house research with premier third-party providers to deliver an exceptional research experience for its clients.

The broker offers a wide array of tools across its website and trading platforms, including videos, articles, and podcasts.

Clients can access daily analyst updates in the Market Analysis section, featuring insights from Saxo Bank’s own analysts. Additionally, news headlines are streamed from reputable sources such as Dow Jones, NewsEdge, and RanSquawk.

Usability: Saxo Bank centralizes its research offerings within the SaxoTraderGO and SaxoTraderPRO platforms. The bank also incorporates third-party trading signals and analysis from Autochartist.

Video Content: Video research is seamlessly integrated into Saxo Bank’s website and platforms. The “Saxo Bank’s Fintech Unfiltered” series is particularly valuable.

Although many of Saxo Bank’s videos are unlisted on YouTube, they are readily accessible through the bank’s websites and trading platforms, reflecting their focus on integrated content delivery.

Reports: The research team at Saxo Bank provides comprehensive quarterly outlooks and annual forecast reports, available in PDF format and often accompanied by videos. These reports offer high-quality research to help traders and investors make informed, theme-based investment decisions.

Saxo Bank offers extensive customer support accessible via phone, email, or live chat, backed by a large team providing detailed assistance with quick responses. Although not available 24/7, the help desk ensures comprehensive support for traders.

Notably, Saxo Bank maintains a regulated office in DIFC, Dubai, under the supervision of the DFSA, catering to UAE traders with services available in Arabic. This local presence enhances accessibility and support for regional clients

Overall, Saxo Bank is a well-established broker offering a robust trading platform with a wide range of instruments and advanced features, making it particularly suitable for professional and higher-volume traders in the UAE.

The high capital requirements for the Platinum and VIP accounts align with the needs of experienced traders who can benefit from reduced fees, access to exclusive events, and enhanced support.

With its extensive regulatory oversight and superior research capabilities, Saxo Bank provides a secure and sophisticated trading environment for serious investors.

Saxo Bank Articles

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.