Selecting the right forex and CFD broker is like picking a partner for your trading journey.

It’s probably the biggest decision you can make as a trader, and it can mean the difference between you succeeding or failing in the markets.

With countless UAE-based brokers trying to get your attention, you need to know what sets a reliable broker apart. Here’s a guide to help you make an informed decision and find a broker that suits your trading needs.

When it comes to trading, safety is non-negotiable.

Before you even consider opening an account, make sure the broker is regulated by a reputable financial authority.

For local entities in the UAE, ensure your broker is regulated by any of the following financial regulatory bodies in the United Arab Emirates:

🔻 Securities and Commodities Authority (SCA)

🔻 Dubai Financial Services Authority (DFSA)

🔻 Financial Services Regulatory Authority (FSRA)

If you’re planning to trade with a non-local entity, look for regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), who impose strict standards to protect traders' interests.

Why is regulation so important? Well, a regulated broker means your funds are held securely, and the trading environment is fair and transparent—key pillars of a reliable trading experience.

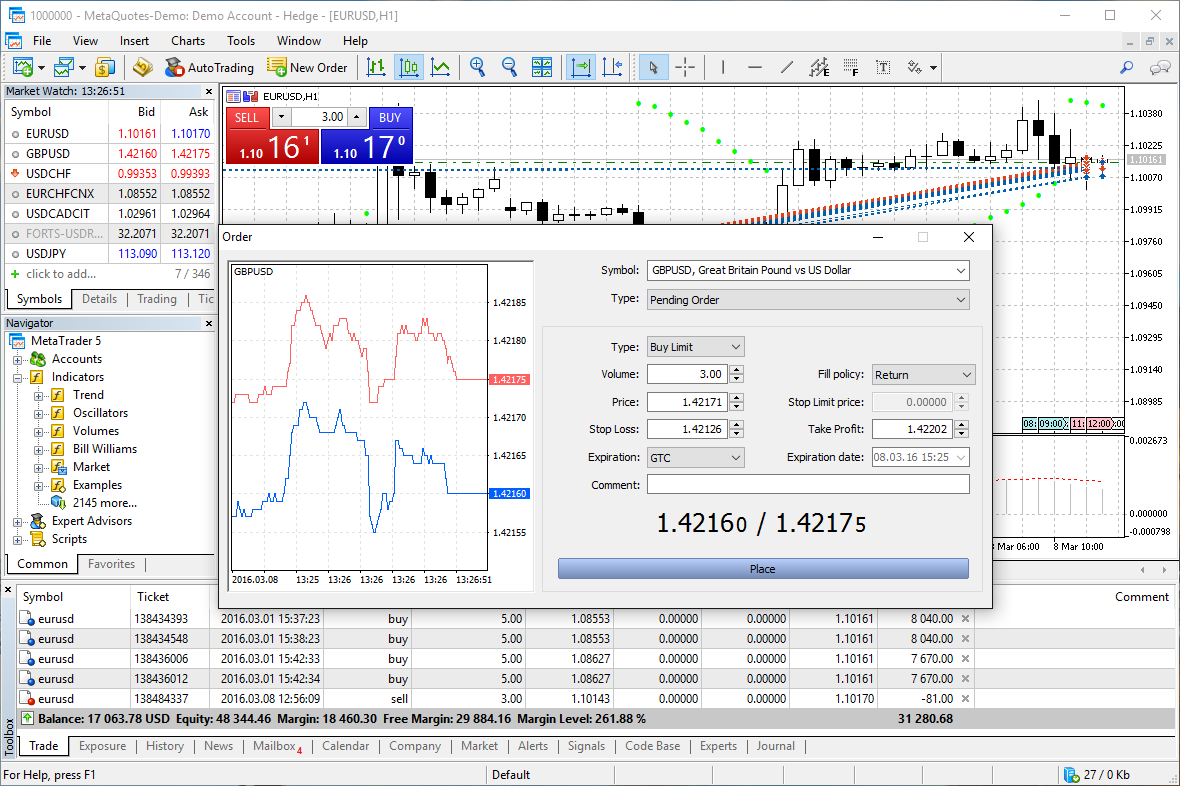

Think of a trading platform as your cockpit in the trading world. It’s where you’ll spend most of your time, executing trades, analyzing charts, and making key decisions.

Look for a platform that is not only user-friendly but also packed with the tools you need.

Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have earned a solid reputation for good reason—they’re intuitive and come with a variety of features for both beginner and advanced traders.

Before committing, consider giving the demo version a test drive to ensure you’re comfortable with its layout and capabilities.

If you haven't read our full guide on choosing a trading platform yet, you can find it here.

A good broker should give you options. You want access to a wide range of tradable assets, such as major and minor Forex pairs, commodities, indices, and CFDs on stocks.

This variety allows you to diversify your portfolio, spreading your risk and taking advantage of different market opportunities. Whether you want to trade oil, gold, or the EUR/USD, make sure the broker offers what you’re interested in.

If you’re not careful, trading costs can eat into your profits.

Brokers generally make money through spreads, commissions, or a mix of both. Look for a broker with competitive and transparent pricing, but don’t be fooled by promises of zero fees.

Check for any hidden costs like withdrawal fees, inactivity charges, or overnight financing costs.

A broker that’s upfront about its fee structure is one you can trust.

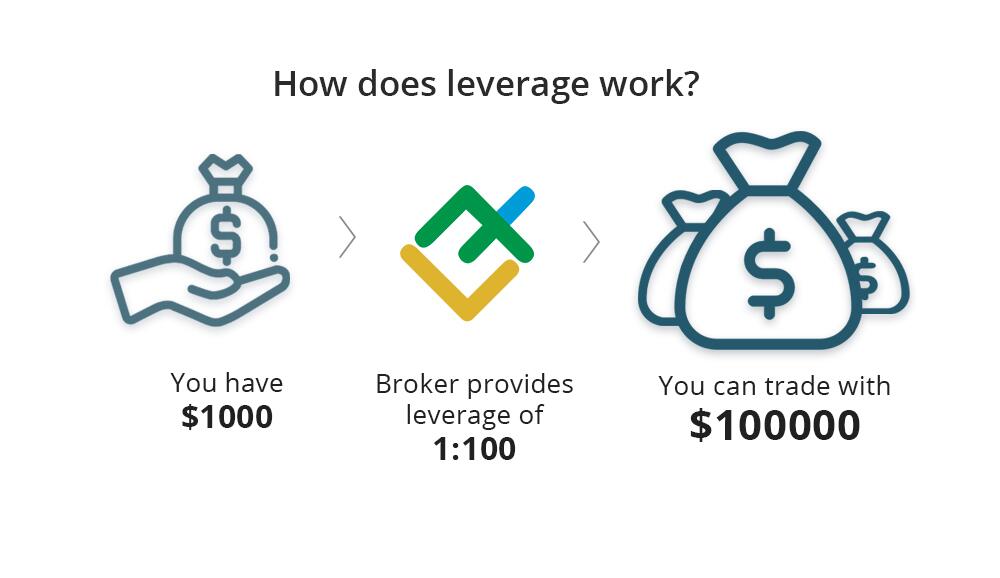

Leverage can be both a blessing and a curse. It allows you to control a larger position with a smaller amount of capital, potentially amplifying your profits.

But let’s not forget—it can also magnify your losses.

Different brokers offer different leverage ratios, so choose a broker that aligns with your risk tolerance and trading strategy. If you’re just starting, a lower leverage ratio can help protect your capital.

Trading isn't always about what you know, but who you know. That’s why reliable customer support is vital, especially if you’re trading during volatile market hours.

Look for brokers that offer 24/5 support via live chat, email, or phone. Prompt and knowledgeable support can make a world of difference, whether it’s a technical issue or just a simple question about your account.

The best brokers aren’t just interested in a first time deposit—they’re invested in your growth.

A quality broker provides educational resources like webinars, tutorials, articles, and market analysis. This is especially important for beginners, as it can help you develop your trading skills and stay informed about market trends.

A broker that encourages you to learn is a broker that wants you to succeed.

Remember, you’re not alone in your search for the right broker.

Take the time to read reviews and testimonials from other traders. Websites like Trustpilot and Forex Peace Army can offer valuable insights into the experiences of other clients.

A broker with a solid reputation and positive reviews is more likely to provide a satisfying trading experience. Watch out for consistent red flags, like problems with withdrawals or poor customer service.

Choosing the right forex & CFD broker can seem hard due to a long list of brokers out there. To make it easier, list down the most important things that you need and go from there.

If you’re not exactly sure, consider the points above, such as regulation, trading platforms, trading instruments, fees, leverage, customer support, educational resources, and reputation. With these, you can narrow down your options and find a broker that aligns with your goals and needs.

Remember, your broker is your partner in the trading world. Take the time to do your research, test the platform, and read reviews. A reliable broker not only keeps your funds safe but also equips you with the tools, support, and knowledge you need to thrive in the market.

When you’ve found the right broker, you’re well on your way to achieving your trading goals.

For more in-depth analysis and the latest updates in the trading world, stay tuned to FX Newsroom.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply