Ever visited the local markets as a tourist?

Maybe you spot something you really like. But instead of buying it right away, you decide to play it cool. You know the shop assistant might give you a better price if you wait. So, you tell them, "I’ll buy it, but only if and when you drop the price."

This is the essence of a pending order in trading—you’re setting the terms and waiting for the right moment to make the trade. If your conditions are met, the order gets filled. If not, you stay out of the market.

Like in the example, pending orders let you decide the exact price you’re willing to pay, or accept, for a financial instrument. You’re not rushing in. You’re waiting for the market to come to you, on your terms.

Now, let’s dive deeper into how pending orders work and why they can be such a powerful strategy for traders.

A pending order is simply an instruction you give your broker to buy or sell a financial instrument at a specific price in the future.

Unlike market orders, which are executed immediately at the current price, pending orders kick into action when the market price reaches the level you specify.

They’re like a reservation—setting your intention in the market for when the time is just right.

There are two main types of pending orders: limit orders and stop orders. Each one has its own specific use, depending on what you want to achieve with your trading.

🔺 Limit orders: A limit order instructs your broker to buy or sell at a better price than the current market level. For example, if you want to buy a stock at $50 but it’s currently at $55, you’d place a buy limit order at $50. If the price drops to your desired level, the order is triggered.

🔺 Stop orders: A stop order, on the other hand, is set to buy or sell once the market hits a worse price. Sounds counterintuitive, right? But if you expect the price to continue trending in a certain direction, a stop order can ensure you ride the wave once it takes off. For example, if EUR/USD is currently trading at 1.2000, and you believe a break above 1.2050 will lead to a strong rally, you’d set a buy stop order at 1.2050. Once the market reaches that price, the order is filled, and you’re in.

Pending orders are all about having control and precision. They allow you to pre-plan your trades without having to watch the charts around the clock. You’re essentially putting your strategies on autopilot—ensuring that your orders are executed when certain price levels are reached, even if you’re asleep or away from your trading desk.

Here are some of the main reasons why traders use pending orders.

🔺 Avoid emotional trading

Markets can be unpredictable, and emotions can lead to bad decisions. By using pending orders, you establish a clear trading plan and stick to it, avoiding the stress of making impulsive moves in the heat of the moment.

🔺 Take advantage of key levels

Markets often react strongly at certain support and resistance levels. By placing pending orders at these levels, you ensure you’re ready to trade once the market makes its move, without needing to manually execute the order.

🔺 React to news and events

The forex market, in particular, can be heavily influenced by economic news and reports. Instead of trying to time your reaction perfectly, a pending order can position you ahead of time, allowing you to capitalize on big price swings as they happen.

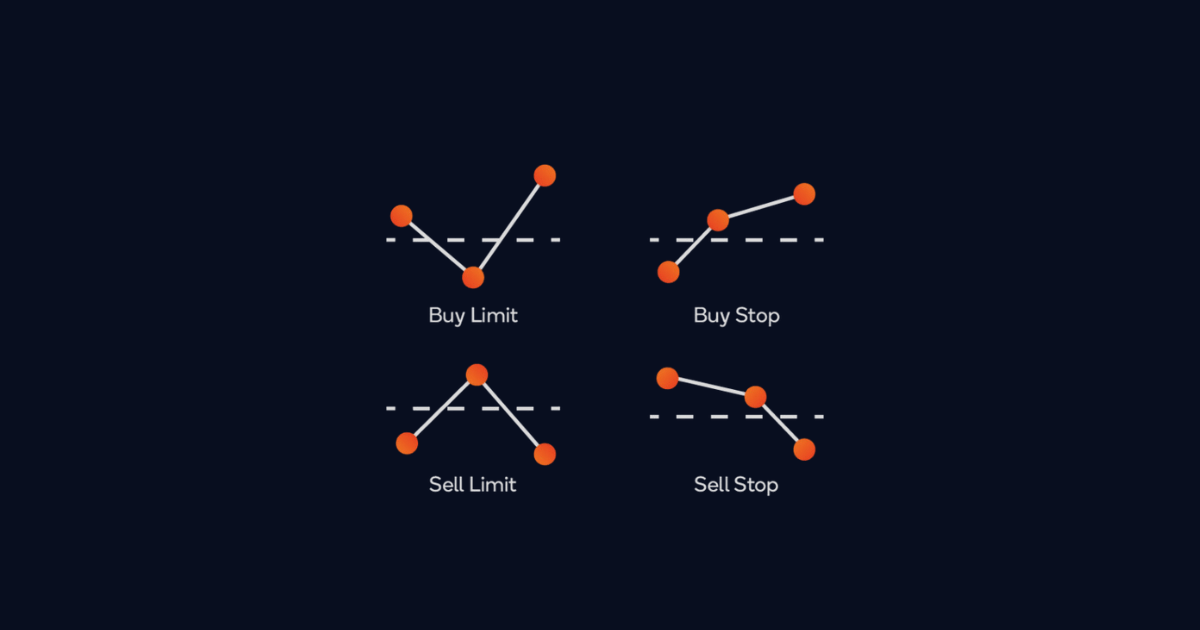

To get a better grip on how pending orders work, let’s break down the four main types.

🔺 Buy limit: You want to buy an asset at a price lower than its current level. For example, if EUR/USD is at 1.2200, and you think it will dip to 1.2150 before climbing, you’d place a buy limit order at 1.2150.

🔺 Sell limit: You want to sell an asset at a price higher than its current level. Let’s say you’re holding gold, and it’s trading at $1,800. You believe it could spike to $1,850, so you place a sell limit order there.

🔺 Buy stop: You want to buy once the price breaks above a specific level. If GBP/USD is trading at 1.3100, and you think a break above 1.3150 will lead to a continued uptrend, you place a buy stop at 1.3150.

🔺 Sell stop: You want to sell once the price drops below a specific level. If the current price is 1.4000, and you think a fall below 1.3950 signals a further decline, you’d place a sell stop at 1.3950.

The biggest advantage of using pending orders is control.

You get to dictate the price at which you’re willing to trade, ensuring you don’t overpay or miss out on key opportunities.

It’s all about patience—waiting for the market to come to you rather than chasing it.

However, pending orders also have their drawbacks. Just because you’ve placed a pending order doesn’t mean it will always work in your favor.

Sometimes, the market might trigger your order and then immediately reverse, which can lead to losses.

Additionally, in highly volatile markets, there’s a risk of slippage—the order might be executed at a slightly different price than expected, especially during sharp price moves.

Let’s say you’re trading crude oil for example, which is currently priced at $75 per barrel. You assume from your technical analysis that if the price falls to $73, it would be an ideal entry point to buy, as it aligns with a major support level.

Instead of watching the charts continuously, you set a buy limit order at $73. If the price dips to that level, your broker automatically executes the trade, ensuring you don’t miss the opportunity.

Alternatively, let’s say you’re eyeing a potential breakout. If oil crosses above $78, you think it will keep rallying. You can place a buy stop order at $78, and if the market breaks that level, you’re instantly in—no hesitation, no delay.

While market orders are all about speed and executing at the current price, pending orders are about strategy.

They let you plan in advance, ensuring you enter and exit trades at precisely the prices you want. Market orders are useful when you need to get in right now, but pending orders are ideal when you want to be patient and wait for the market to come to your level.

Pending orders are powerful tools for traders who want to plan their trades and avoid the emotional pitfalls that come with watching the market in real time.

Whether you’re setting a limit order to buy at a more favorable price or placing a stop order to catch a breakout, pending orders allow you to execute your strategy with precision and confidence.

Trading isn’t always about reacting—it’s about having a plan.

With pending orders, you can put that plan into action without constantly staring at your screen. So, take advantage of this tool, automate your trades where possible, and give yourself the flexibility to seize opportunities when the conditions are just right.

After all, sometimes the best trades are the ones you set up in advance and let the market do the rest.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply