When the time comes for any major central bank announcement, it means two things.

One, low-risk traders run into hiding. And two, it means volatile markets.

Big central bank announcements are always placed under the microscope, especially for forex traders.

These announcements, which often include interest rate decisions, economic forecasts, and policy adjustments, ripple across global economies, causing major market volatility.

Let’s break down how central bank policies impact trading and how you can position yourself to capitalize on these events.

While most traders focus on interest rate changes, central bank announcements encompass much more.

Central banks, like the Federal Reserve (Fed) in the US or the European Central Bank (ECB), manage their nations’ monetary policy, aiming to stabilize inflation, promote employment, and ensure economic growth.

Goals And Objectives Of Central Bank Intervention, Source: FasterCapital

Their toolkit includes not only adjusting interest rates but also implementing quantitative easing (QE) and providing forward guidance on the economic outlook.

Let’s look at an example. When central banks hint at future interest rate hikes to combat inflation, it sends a strong signal to markets that the currency will likely strengthen.

That’s because higher interest rates attract foreign investments, increasing demand for the currency.

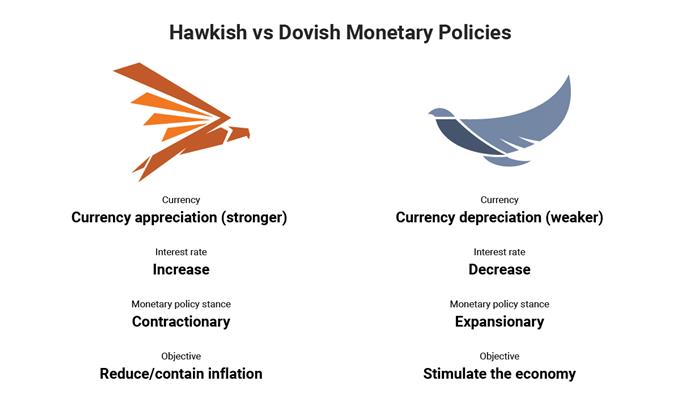

On the flip side, dovish policies, where rates are cut to stimulate economic growth, can weaken a currency as investors search for better returns elsewhere.

Central bank decisions have huge implications—they set the tone for everything from currency valuations to stock market performance.

Even before an official announcement, traders often try to anticipate a central bank’s move by analyzing expectations and the general economic outlook.

A key concept here is market sentiment. If traders think that a central bank will turn hawkish, they might start buying that currency in advance, causing the price to move even before the decision is made public.

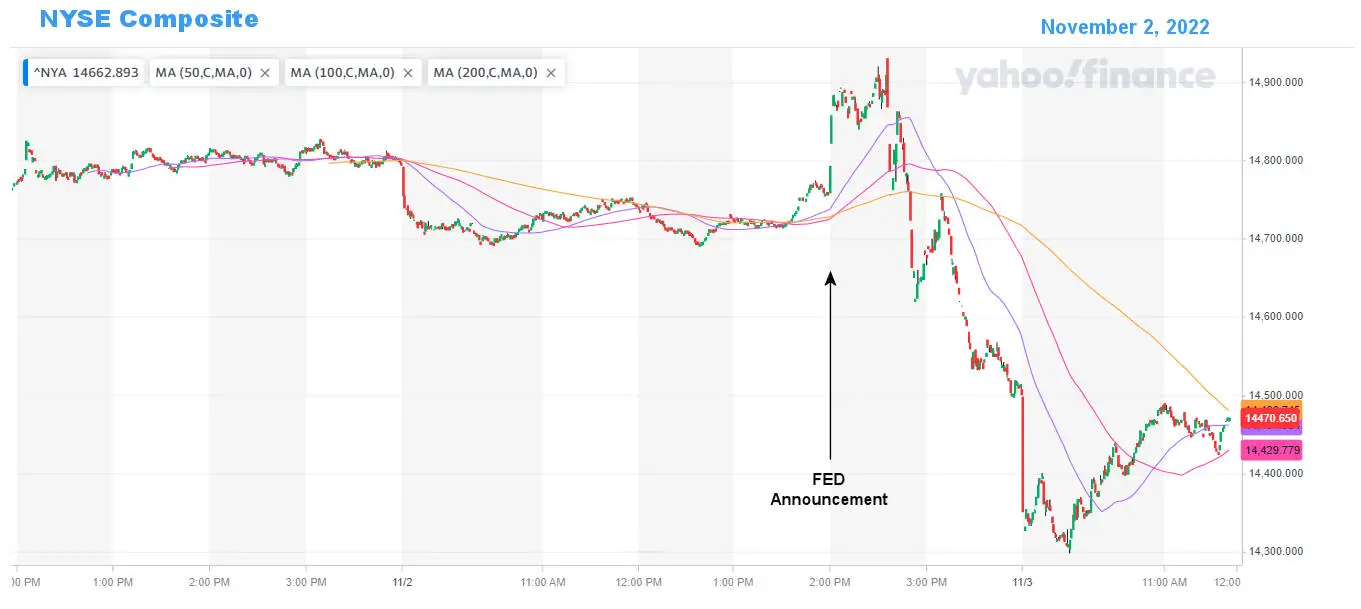

After a central bank meeting, reactions can be immediate and volatile.

For instance, if the Fed announces an unexpected rate hike, the US dollar can surge in value within minutes.

Example of market volatility during Fed Announcment, Source: InflationData.com

While it’s an unlikely scenario, traders need to be agile, either taking advantage of these short-term movements or positioning themselves for the long-term effects of policy changes.

Central bank officials have a language of their own. And sometimes traders don’t speak it fluently.

To anticipate the market reaction to central bank announcements, you need to understand that traders and investors react to the specific tone and language of the bank’s officials when they make those announcements. They aren’t just reacting to the decision itself.

Terms like “hawkish” suggest tightening policies, while “dovish” implies more lenient, growth-oriented measures. Even the simplest of phrases spoken by major players like Jerome Powell, Chair of the Fed, can bring major volatility if traders interpret his language a certain way.

Hawkish vs. Dovish Monetary Policies, Source: IG

Not all central banks are created equal in the eyes of the global markets.

While nearly every country has a central bank, some wield far more influence than others. These are the key players you need to pay attention to.

The Federal Reserve

As the overseer of the world’s largest economy, the Fed’s decisions have global ramifications. Traders hang on every word during Fed meetings, as its policies can shift the entire direction of global markets.

The European Central Bank

Managing the euro, the ECB influences over 19 countries. Its policies significantly affect not only the euro but also the broader stability of European economies.

The Bank of Japan

Known for its unconventional policies like negative interest rates, the BoJ plays a unique role in influencing global markets, particularly with the yen and Asian economies.

The Bank of England

With the British pound being one of the world’s most traded currencies, the BoE’s clear communication style gives traders early hints about future monetary policy changes.

Trading around central bank announcements can be highly profitable due to the volatility, but also comes with risks.

Some traders take positions before the announcements, betting on anticipated moves. Others wait for the dust to settle after the initial volatility to better gauge the long-term market direction.

Traders can also leverage interest rate differentials.

For example, if the Bank of England raises rates while the ECB maintains low rates, traders may opt to go long on the pound and short on the euro, capitalizing on the widening gap between the two.

In addition to short-term trading opportunities, central bank announcements offer insights into long-term economic health.

When a central bank commits to reducing inflation or stimulating employment, these policies set the stage for future economic conditions.

For traders, this information is invaluable for positioning themselves in not just forex but also equity and bond markets, where central bank policy directly influences yields and returns.

In financial markets, central bank announcements are major market drivers.

These decisions set the stage for future economic trends, impacting everything from currency movements to bond yields and equity valuations. For traders, the ability to interpret the signals from central banks is crucial.

By understanding the policies and actions of major players like the Fed, ECB, and BoE, you gain insights not only into short-term market volatility but also long-term economic health.

Staying in the loop of central bank announcements gives you the insights to make informed, strategic moves, helping you stay ahead of the curve and capitalize on both immediate opportunities and future potential shifts.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply