For traders in the UAE and GCC, oil is much more than a traded commodity—it fuels entire economies, livelihoods, and markets.

Central to the volatility of this market is OPEC (Organization of the Petroleum Exporting Countries), whose policies hold considerable sway over oil prices. To be a successful trader in this region, particularly in commodities like oil and natural gas, grasping OPEC's role is essential. Here’s why.

OPEC, comprising 13 oil-producing nations, including Saudi Arabia and the UAE, regulates the global oil supply. This isn't just about keeping production steady—it’s about maintaining influence.

By controlling supply, OPEC indirectly governs global pricing, ensuring economic stability for its members while influencing markets worldwide.

For traders in the Middle East, these decisions impact more than just oil—they shift currency valuations, equities tied to the oil sector, and regional economies.

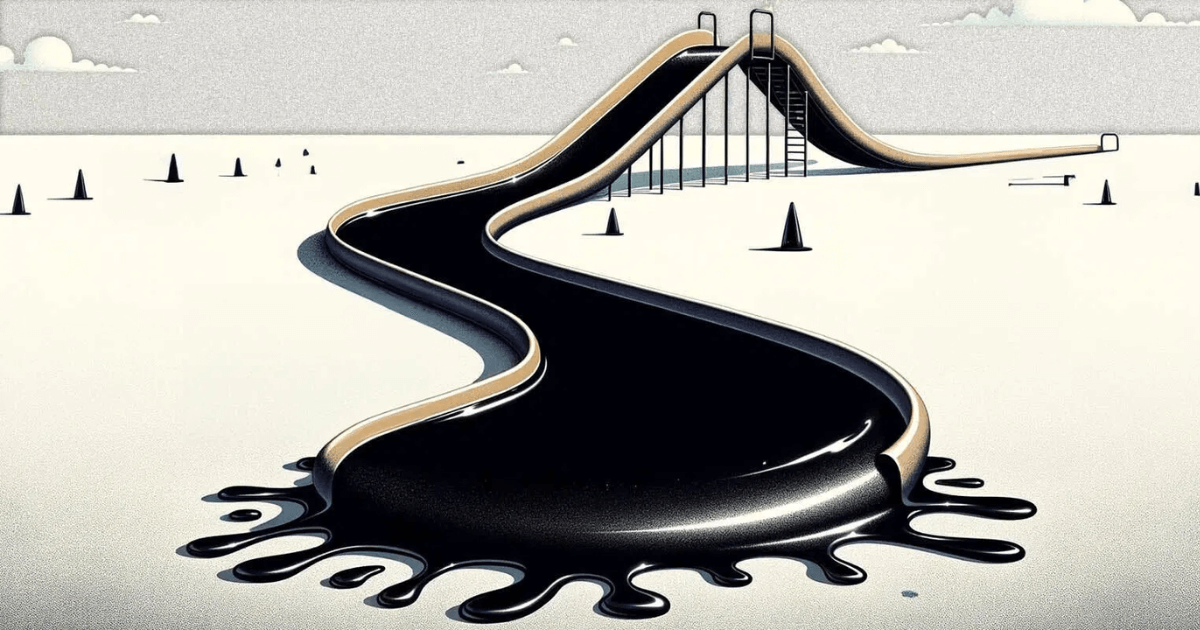

But OPEC isn’t a static force. Its actions send ripples far beyond oil wells, affecting markets in ways that traders need to monitor closely. It’s a careful balancing act, and understanding the subtle shifts in OPEC policies can provide insight into future market movements.

OPEC wields power through a fundamental lever—supply control.

When prices dip too low, OPEC may reduce production, decreasing supply and pushing prices back up. Conversely, when prices soar, increasing output can stabilize the market.

For traders, particularly those in the GCC, tracking these moves is critical. A decision by OPEC to cut supply can tighten global markets, driving up oil prices and bolstering regional currencies like the UAE dirham.

This interplay between oil production and market response creates opportunities, especially in forex and commodities trading.

OPEC’s influence became even more pronounced with the inclusion of non-OPEC members like Russia, forming OPEC+. This alliance allows for greater control over global oil supplies, amplifying the impact of collective decisions.

As a result, OPEC+ agreements can trigger significant shifts in oil prices, which in turn affect broader financial markets.

Recent OPEC+ meetings have led to dramatic fluctuations, not just in oil prices but across assets, including currencies and stocks. Traders attuned to the outcomes of these meetings can anticipate movements and position themselves strategically.

However, while volatility can create opportunities, it also brings risk. Understanding both the immediate and long-term market impacts of OPEC+ announcements is essential for making informed trading decisions.

While OPEC remains dominant, it faces a growing challenge—sustainability.

As the world shifts towards renewable energy and reduces its reliance on fossil fuels, OPEC’s strategies must evolve. This shift presents both risks and opportunities for traders.

While oil will remain a crucial component of the global energy mix for years to come, diversifying portfolios into cleaner energy investments could prove beneficial for long-term growth.

Traders in the GCC should pay attention not only to oil prices but also to how OPEC navigates the energy transition.

OPEC meetings are regarded as high-stakes events in the oil markets. Prices can surge or plummet based on the outcomes, offering traders opportunities to speculate or hedge.

Monitoring these events closely can yield valuable insights, whether you’re positioning for short-term gains or adjusting your long-term strategy.

However, it’s not just about reacting to the news. Successful traders understand the broader economic implications of OPEC’s decisions, such as currency fluctuations and shifts in oil-related equities.

Preparing for both the volatility and the subsequent market trends is key to navigating the unpredictable oil markets effectively.

If you’re an oil trader, or looking to get started, understanding OPEC’s influence on oil prices is not a luxury—it’s a necessity. OPEC shapes more than just the price of crude; it molds economies, currencies, and financial markets.

By staying informed on OPEC’s policies, production levels, and geopolitical factors, you can position yourself to navigate the oil markets with greater understanding and confidence.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply