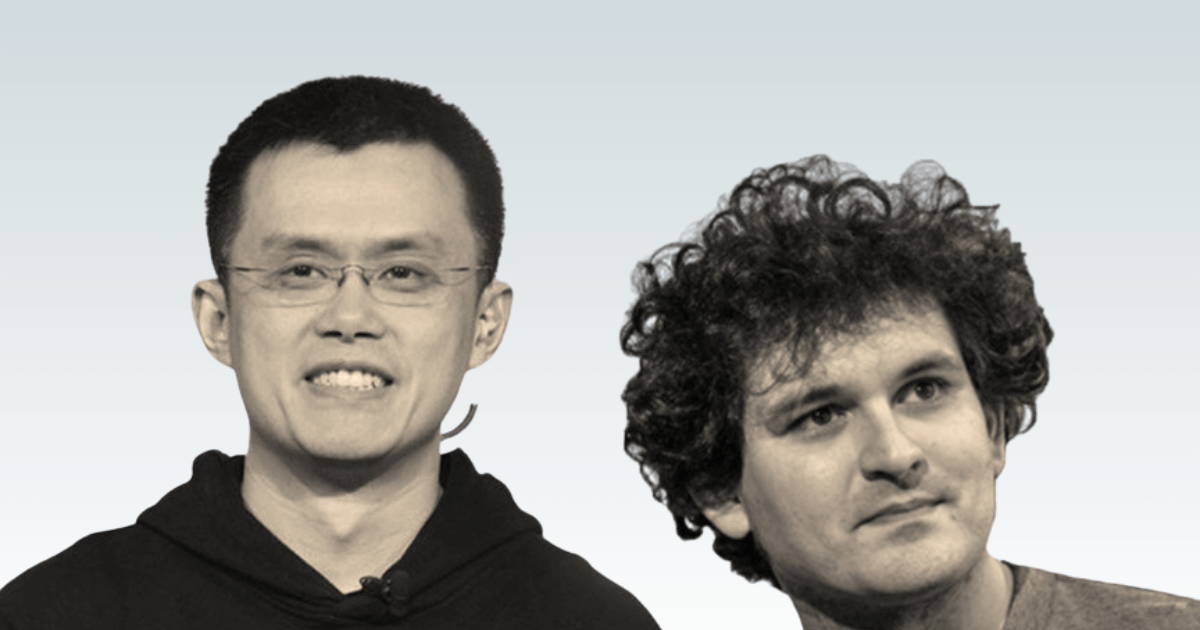

FTX has initiated legal action against Binance and its former CEO, Changpeng Zhao (CZ), seeking $1.8 billion in damages. Filed in Delaware’s bankruptcy court, the lawsuit alleges that a 2021 transaction—wherein Binance sold its stake in FTX—was funded by an insolvent Alameda Research, FTX’s trading arm, which lacked sufficient capital to complete the deal legitimately.

The dispute traces back to Binance's initial investment in FTX in 2019. Two years later, in July 2021, Binance agreed to divest its shares in FTX, receiving approximately $1.76 billion in FTX’s FTT tokens as well as Binance’s BNB and BUSD tokens as payment.

FTX's administrators now argue that Alameda, already in financial trouble, borrowed funds from FTX to facilitate the buyback, describing it as a “fraudulent transfer” that disadvantaged FTX’s creditors. FTX seeks to reclaim these funds for creditors impacted by the transaction.

The suit also accuses CZ of destabilizing FTX by unloading Binance's substantial FTT holdings in November 2022, just prior to FTX’s collapse. FTX claims that CZ’s public remarks during that period damaged its reputation and contributed to the financial turmoil that led to the exchange’s downfall. The collapse ultimately resulted in the conviction of FTX founder Sam Bankman-Fried on fraud charges, spotlighting the regulatory scrutiny facing both exchanges.

In response, Binance dismissed FTX's claims as without merit, pledging to contest the lawsuit in court. This latest legal clash underscores the deepening rift between the former industry leaders, whose rivalry has only intensified since FTX’s collapse—a downfall that some attribute in part to Binance's actions.

Sign up to get the inside scoop on today’s biggest stories in markets, finance, and business.

By clicking “Sign Up”, you accept our Terms of Service and Privacy Policy. You can opt-out at any time by visiting our Preferences page or by clicking "unsubscribe" at the bottom of the email.

Leave a Reply