NEWS

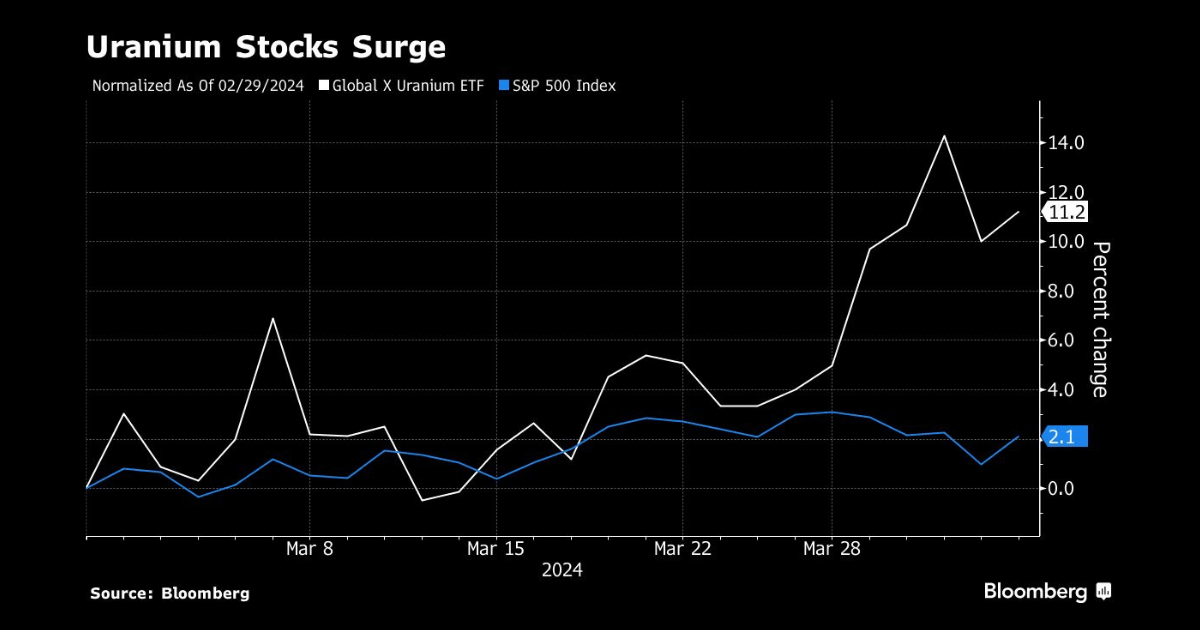

An article from Reuters earlier this year on the Uranium markets painted a prosperous picture for the global Uranium market.

The report stated: “Investment banks Goldman Sachs and Macquarie as well as some hedge funds are positioning themselves to reap the benefits of a newly buoyant uranium sector as prices of the nuclear fuel ingredient spike.

While many other investment banks are still avoiding uranium, Goldman and Macquarie are boosting trading in physical uranium and in Goldman’s case trading its options as well, five industry and hedge fund sources with knowledge of the deals said. The heightened activity comes as utilities seek new supplies amid shortfalls that have lifted prices to 16-year highs.”

Now, hedge funds are also stepping up involvement in both equities and physical uranium, a sign that the metal is starting to broaden its appeal to financial institutions.

With the headlines and positive momentum in nuclear more generally, hedge funds and other commodity investors are back in the uranium sector.

“A lot of it is done via physical funds, the easiest way to get exposure to uranium prices,” said Bram Vanderelst at trading firm Curzon Uranium.

The metal has captured investors’ attention after prices doubled over the past year to $102 per pound as top producers Kazatomprom and Cameco cut production guidance because reopened mines that had been mothballed struggled to ramp up production to meet renewed demand.

It also comes with the revival of nuclear energy to help countries cut their carbon emissions, which was highlighted in the December 2023 Group of Seven most industrialized nations’ statement that envisioned tripling nuclear energy capacity from 2020 to 2050.

Goldman Sachs has started writing options on physical uranium for hedge funds, the first time it has created a derivative for the metal.

It concluded: “”Goldman has been increasing their visibility, they’ve been increasing their book steadily,” a confidential source who dealt with the bank said.