PRESS RELEASE

Sarwa Digital Wealth (Capital) Limited (“Sarwa”), U.A.E’s leading investing platform and app with over $10B in cumulative trading volume, is excited to announce the launch of its upgraded product, Sarwa Save+. Building on the success of Sarwa Save, Sarwa Save+ offers an even higher yield, making it a compelling addition to Sarwa’s diverse range of investment products.

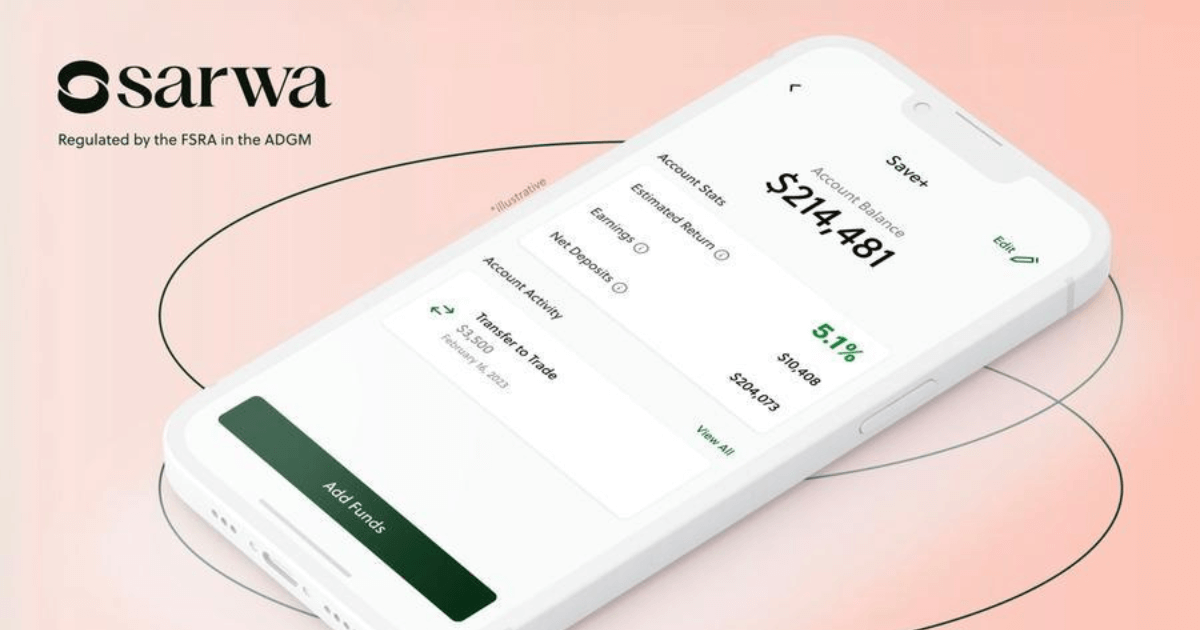

Sarwa Save+ is designed as a high-yield money market fund with an estimated return of 5.1%, a significant increase from the previous 3%. This product continues to provide the key advantages of its predecessor: a low-risk and highly liquid investment vehicle, zero transfer costs for AED local accounts, no account minimums, and an easy and fast online onboarding process.

“We continuously strive to enhance our product offerings based on the evolving needs of our clients and market conditions. With the launch of Sarwa Save+, we are offering a superior low-risk investment option that yields higher returns while maintaining the same ease of access and simplicity that our clients have come to expect from Sarwa.” Mark Chahwan, Co-founder and CEO of Sarwa.

Sarwa aims to centralize all investment needs within one app, catering to both long-term and short-term financial goals. Sarwa Save+ provides a robust option for parking cash while earning significant returns. “Sarwa Save+ allows clients to diversify away from low-yield savings accounts and earn significantly higher returns from highly liquid assets,” added Mark Chahwan.

The launch of Sarwa Save+ comes at a time when the global macroeconomic environment is marked by significant central bank activities. The US Federal Reserve, for instance, has raised interest rates to a 23-year high of 5.25% to 5.5% to combat persistent inflation amid robust economic growth. As inflation shows signs of slowing but remains above the Fed’s target, the central bank’s future rate projections are closely watched by investors. These global financial trends underscore the importance of adaptable investment strategies like Sarwa Save+, which provide higher returns in a low-risk framework, aligning well with the current economic climate and investor needs.

-Ends-

About Sarwa

The Sarwa is an investment platform dedicated to helping everyone make their money work, regardless of age, net worth, or background. Sarwa makes investing easy, simple, and affordable with low account minimums and fees across a wide range of products. Sarwa Invest offers hands-off long-term diversified investing, Sarwa Trade provides self-directed trading for ETFs and stocks, and Sarwa Save+ is a high-yield money-market funds vehicle. Sarwa was founded by a team of financial, technology, and management experts and is backed by top regional and international stakeholders. Sarwa Save+ is a product of Sarwa Digital Wealth (Capital) Limited, regulated by the ADGM Financial Services Regulatory Authority. All investments involve risk. To learn more, visit www.sarwa.co.

Disclaimer: This investment vehicle is considered extremely low-risk, however, keep in mind that like all investments, there is always risk involved. Estimated returns are before Sarwa’s management fees and are based on current federal fund rates and other economic factors, which are subject to change. Past performance is no guarantee of future results.

Fxnewsroom – Real-time Forex News and the latest trading updates.