NEWS

Tradeweb Markets Inc. (NASDAQ: TW) has unveiled its financial results for the first quarter of 2024, showcasing a robust performance during the three months ending in March.

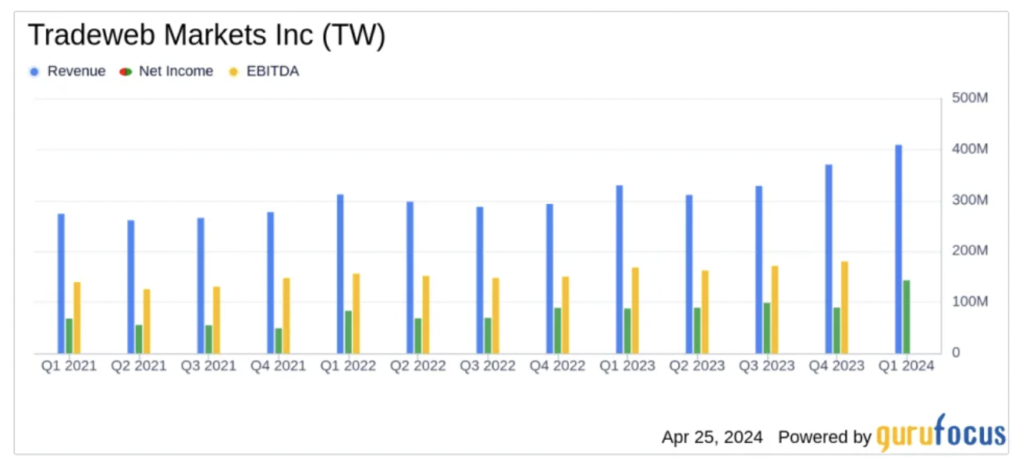

The company generated $408.7 million in revenue, reflecting a 24.1% increase compared to the previous year, albeit slightly below analysts’ expectations of $411.33 million. However, the standout figure was the average daily trading volume, which surged to a record $1.9 trillion—an impressive 39.1% surge year-over-year.

Net income also witnessed a significant uptick, reaching $143.4 million, up 40.3% from the previous year, while earnings per share (EPS) met estimates with an adjusted diluted EPS of $0.71.

Operationally, Tradeweb’s adjusted EBITDA rose to $219.5 million, with margins expanding to 53.7% from 52.3% the prior year. Additionally, the company declared a quarterly cash dividend of $0.10 per share, payable on June 17, 2024.

In terms of growth strategies, Tradeweb finalized the acquisition of r8fin and announced an impending acquisition of ICD for $785 million, slated to close in the second half of 2024.

Billy Hult, CEO of Tradeweb, emphasized the company’s widespread growth and success across various asset classes. He underscored Tradeweb’s commitment to innovation and the expansion of its multi-asset class trading solutions to maintain competitiveness in global financial markets.

Recently, Tradeweb Markets Inc announced its definitive agreement to acquire Institutional Cash Distributors LLC, an institutional investment technology provider catering to corporate treasury organizations. The acquisition, valued at $785 million, is subject to customary adjustments and is expected to be funded through cash on hand.

Looking forward, Tradeweb intends to continue investing in technology and strategic initiatives, with adjusted expenses for 2024 expected to be at the higher end of the $755 – $805 million range.

Tradeweb aims to broaden its presence in fixed income trading by integrating an algorithmic technology provider into its network through the acquisition of r8fin. This acquisition complements Tradeweb’s recent purchase of Yieldbroker for A$125 million, aligning with its overarching growth strategy through strategic market acquisitions.